Income Certificate for Foreigners’ Authority — Einkommensbescheinigung für Ausländerbehörde

Many residence permits require proof of a secure means of subsistence. Under German law this is an overall requirement for residence permits (§ 5 Residence Act) and is defined as subsistence without relying on public funds and with adequate health insurance (§ 2(3) Residence Act).

Foreigners’ authorities often request an income certificate (frequently based on the “net disposable income” concept).

The requirement to the tax consultant / certified auditor is not just to sign the form. We are obliged to review and substantiate the income position including supporting documents, so the application is professionally prepared and compliant with authority requirements.

Who needs to show the Income Certificate to the Foreigners’ Authority

Employees (initial application, extension, permanent settlement permit) – see also BMI FAQ on residence law)

Self-employed / freelancers (incl. projections where income fluctuates). For example Frankfurt explicitly requests a tax advisor’s certificate of net disposable income) – see the city’s guidance and form: Frankfurt forms overview / PDF “Net disposable income”

Family reunification (proof by/for the person residing in Germany)

EU Blue Card (salary threshold + proof of subsistence; see current thresholds on Make it in Germany: EU Blue Card, Skilled Immigration Act update)

Cases with a complex document set (multiple income sources, probation periods, variable bonuses)

Our scope – more than just a signature

We provide a complete, traceable and verifiable basis for the authority’s decision. This includes:

Plausibility review of your net income situation for the past 6 or 12 months

Comparison of income vs. regular household needs (rent/heating, insurance, maintenance) – aligned with how authorities assess subsistence (see BAMF overview on subsistence: BAMF info)

Document review: pay slips, invoices, bank statements/transactions, tax assessments, VAT returns

Completion of the official authority form (e.g. PDF “Net disposable income”) incl. stamp/signature

Optional explanatory note: short calculation narrative and assumptions—useful for queries/extensions

Deliverable: A compliant income certificate for foreigners’ authority as PDF (original by post on request).

Required documents (checklist)

General

Rental agreement + latest service charge statement (warm rent)

Any maintenance obligations/payments with evidence

ID/pass copy (for the form, if required)

Which income sources have you had in the last 6 or 12 months?

Since when (exact date) are you (self-)employed, if applicable?

- What exactly do you do professionally? (Type of activity/industry)

Employees

Employment contract (with working hours, probation period, remuneration)

Pay slips for the last 3–6 months

Health insurance confirmation (statutory or private)

If available: most recent income tax assessment

Self-employed / freelancers

Management accounts (BWA/EÜR) or annual financial statements (current)

VAT returns and advance income tax assessment notices

Excel overview of the last months (revenues/costs)

Invoices (sales/purchases) and bank transactions/statements for the review period

Health/pension insurance: evidence + payment proofs

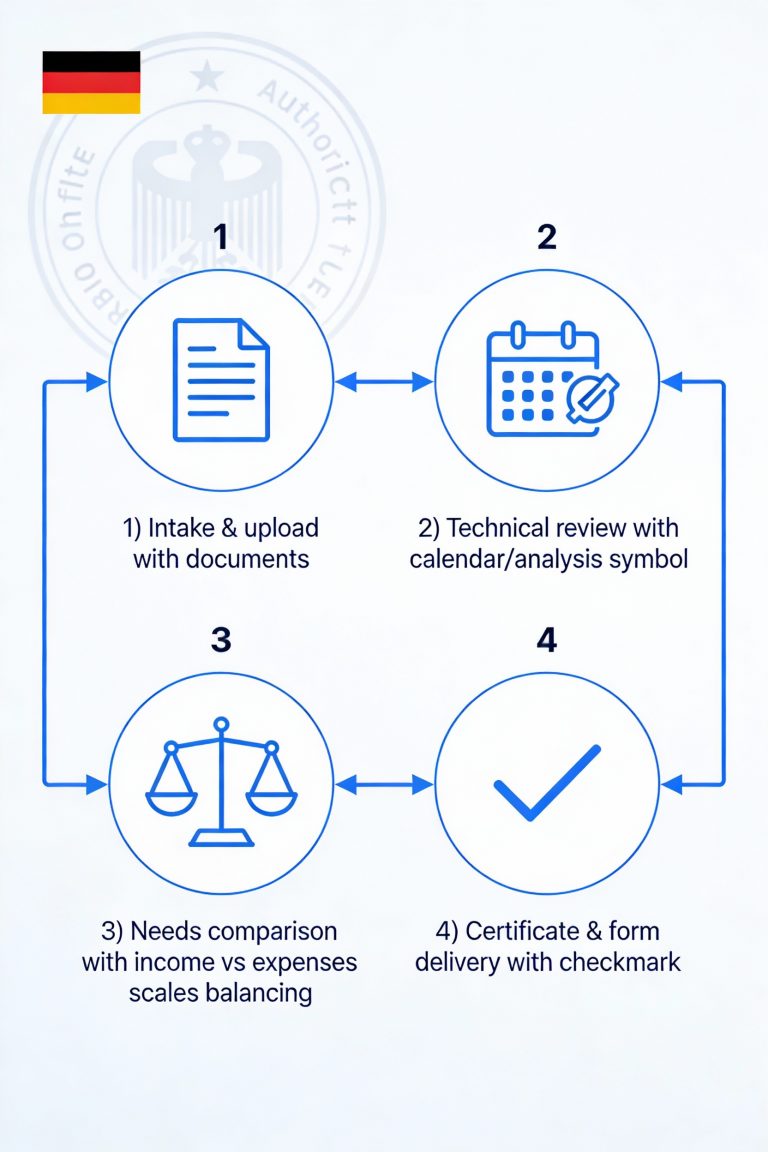

Our process

Intake & upload

You receive our document list and send us the documents. We check completeness and flag any gaps.Technical review (6 or 12 months)

We assess stability (probation/contract terms), fluctuations (bonuses, project revenues) and regularity of incoming payments.Needs comparison

We match net disposable income against ongoing needs (rent/heating, health insurance, maintenance where applicable) in line with how subsistence is evaluated under § 2(3) Residence Act.Clarifications & sign-off

Open points handled via brief call or commented PDF; we incorporate final adjustments.Certificate & form

We complete the official form income certificate for foreigners’ authority, stamp/sign, and deliver as PDF (original by post on request).

Timeline: With complete documents, we can typically complete the work by the end of next week.

Fees & engagement

From experience, cases to complete an income certificate for foreigners’ authority take 3–4 hours—depending on number/type of income sources, variability and document structure.

Hourly rate: EUR 200/hour plus 19% VAT

Typical fee: around EUR 600 — 800 plus 19% VAT per certificate

Advance payment: We issue a retainer invoice for the expected fee before starting work.

Frequently asked questions

Is one recent pay slip enough?

Usually not. Authorities require a stability check, hence 3–6 months are typically mandatory.

Is there a fixed official form?

Many cities/counties use their own templates (e.g., “certificate of net disposable income”). We complete the specific form required by your authority.

What if my income fluctuates (self-employed)?

We add a quarterly/annual projection and show our plausibility trail (management accounts, VAT returns, bank statements). This helps explain volatility objectively.

Is health insurance relevant?

Yes. Without adequate health insurance cover, subsistence is not considered secured. Please include membership/policy confirmations and payment proofs.

Your advantages with Taxmain

Authority-compliant: We know the templates and deliver a formally correct certificate.

Pragmatic & fast: Clear checklist, structured upload, targeted follow-ups.

Traceable: Optional explanatory note with calculation—useful for extensions and subsequent applications.

One stop: Especially for the self-employed, we combine tax, accounting and authority logic—seamlessly.

Ready to proceed? Engage us with the Income Certificate for the Foreigners’ Authority (Einkommensbescheinigung für die Ausländerbehörde)

Please use the contact form below.

Alternatively, you can reach us directly by email or phone; you’ll find our contact details here.

Privacy notice: By submitting the form, you consent to your data being collected and processed for the purpose of responding to your inquiry. Your data will be deleted once your inquiry has been fully processed. You may withdraw your consent at any time with effect for the future by emailing mail@taxmain.de.

Detailed information on how we handle user data can be found in our Privacy Policy.