How does the inheritance tax in Germany work?

Inheritance tax in Germany is a tax on the property of a deceased persons, if this is inherited to other persons. It is based on the value of the assets and property that the deceased individual leaves behind, which is known as the “estate.” The tax is generally levied on the beneficiaries who inherit the assets from the deceased person.

Furthermore, the same calculation / system applies, when the estate is given as a “present”, so in this case, it is a “present tax” (§ 1 Nr. 2 ErbStG).

To settle the inheritance tax in Germany, the beneficiaries have to submit a tax return to the relevant tax authority. This return includes details about the assets, their values, and the beneficiaries’ relationship to the deceased. The tax amount is calculated based on the value of these assets and other information.

What is the tax rate and the amount of the inheritance tax in Germany?

The amount of the inheritance tax in Germany depends on different factors, including the net asset value, the relationship between the deceased person and the beneficiaries, and any applicable deductions or exemptions.

Close relatives such as spouses and direct descendants are granted exemptions or lower tax rates compared to more distant relatives or unrelated individuals. To the exemptions, please see the question about the structure of the inheritance tax law (below).

How should I pay the inheritance tax in Germany if I have no liquidity?

Often, the inherited assets are not “liquid”, for example real estate. So there may not be sufficient liquidity to pay the inheritance tax in Germany, and beneficiaries would need to sell the assets or take a credit to pay the inheritance tax. If this is not possible in short term, usually it is possible to apply for a deferral at the financial authority.

How is the structure of the inheritance tax law in Germany?

The inheritance tax in Germany is regulated by the Erbschaftsteuergesetz (Inheritance Tax Act).

The key points of the German Inheritance Tax Act include:

- Taxable Persons and Beneficiaries:

- The tax is levied on both German residents and non-residents who inherit assets located in Germany (§ 2 ErbStG).

- Beneficiaries can be everyone: relatives (e.g., spouses, children, parents), but also non-related individuals and organizations.

- Tax Rates:

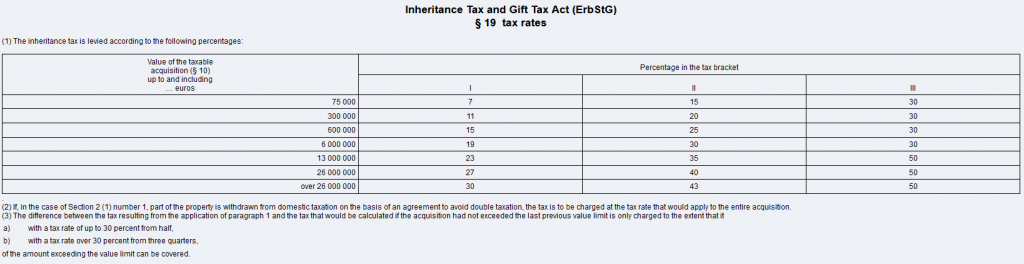

- The tax rates vary based on the value of the inherited assets and the relationship between the deceased and the beneficiary. In general, the tax rate is regulated in § 19 ErbStG:

- Allowances

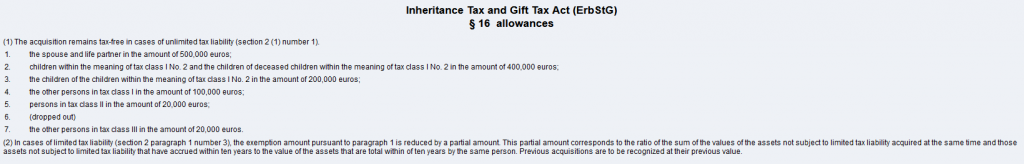

- Spouses and registered partners are generally exempt from inheritance tax.

- For other relatives, there are specific tax-free allowances depending on the degree of kinship.

- Non-related beneficiaries are subject to higher tax rates, and their tax-free allowances are generally lower

- The above mentioned allowances are regulated in § 16 ErbStG:

- Valuation of Assets:

- The value of the inherited assets must be determined as of the date of death of the deceased.

- Different valuation methods are used for different types of assets, such as real estate, securities, and business assets. According to § 12 ErbStG, the valuation methods from the valuation tax law (Bewertungsgesetz) have to be applied.

- Deductions:

- The Inheritance Tax Act provides certain deductions to reduce the taxable amount. They are regulated for example in §§ 13 and 13a ErbStG.

- For instance, business assets may qualify for significant reductions or full exemption to ensure the continuity of businesses after the owner’s death.

- Filing and Payment:

- The beneficiaries are responsible for the declaration of the inheritance tax return and the payment of the inheritance tax-

- The tax return has to be submitted to the financial authority within three months after the date of the death.

- Payment of the inheritance tax is due within six months after the date of death.

- Penalties and Enforcement:

- As every other tax in Germany, also if the inheritance tax in Germany is declared or paid to late, this may result in penalties and interest charges.

- Tax authorities can conduct audits and investigations.

An example how the inheritance tax in Germany for real estate is calculated?

Let’s look at the following example: a person lives in England and inherited a property from his/her uncle who also lives in England. The property is located in Germany. It is a 4‑room apartment in Munich, 100 square meters.

The inheritance tax is calculated according to following structure:

- Valuation of the Inherited Property: The value of the inherited property (4‑room apartment in Munich, 100 sqm) needs to be determined as of the date of the uncle’s death. As explained above, the valuation is done according to § 12 ErbStG based on the rules of the valuation tax law (Bewertungsgesetz). For real estate property, different factors need to be considered, for example the quality of the building, the value of the ground, whether the apartment is rented or not…

For this example, let’s assume that the property was appraised at 400.000 EUR. - Relationship to the deceased person: according to § 15 ErbStG, nieces and nephews are classified as “Steuerklasse II” (tax class II) beneficiaries.

- Tax-Free Allowance (Freibetrag): according to § 16 EStG, the tax-free allowance for “Steuerklasse II” beneficiaries is 20.000 EUR for inheritances from uncles and aunts.

- Taxable Amount: To calculate the taxable amount, we subtract the tax-free allowance from the value of the inherited property: Taxable Amount = 400.000 EUR — 20.000 EUR = 380.000 EUR.

- Tax Rates: according to § 19 ErbStG, the inheritance tax rates for “Steuerklasse II” beneficiaries in Germany are as follows:

- Up to 75,000 EUR: 15%

- Between 75,001 EUR and 300.000 EUR: 20%

- Above 300.000 EUR: 25%

- Calculation of Inheritance Tax: Now, we apply the respective tax rates to the taxable amount:

- 380.000 EUR x 25% = 95.000 EUR

How to continue / contact to us

We as english speaking tax advisors can file the declaration of the inheritance tax in Germany and communicate with the financial authority on your behalf.

You can contact us by using one of these phone numbers or the mail address.